Office of Financial Aid, Education, and Planning Leads Budgeting Workshop

Brent Rice ‘25

Staff Editor

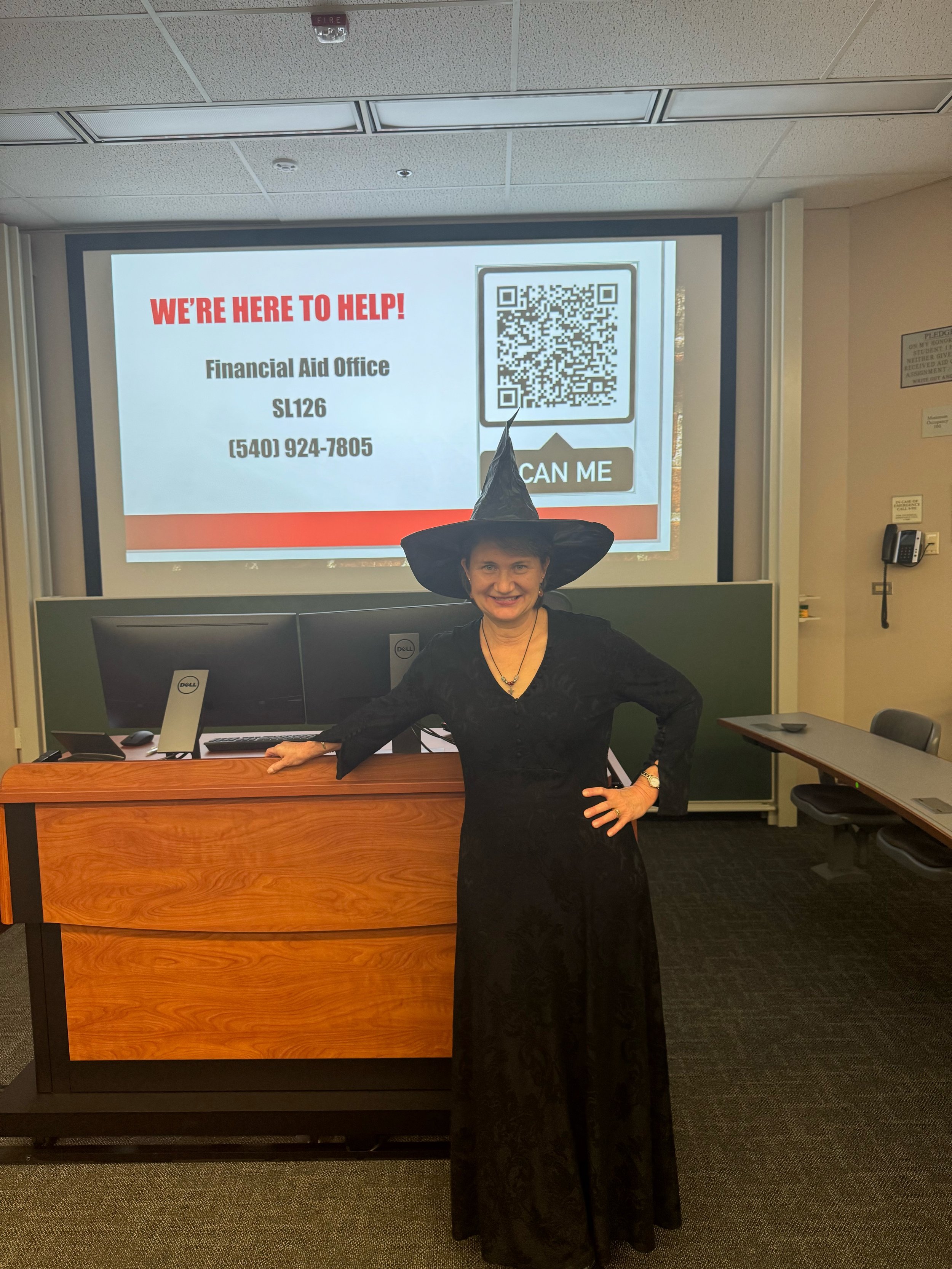

On Halloween day, the Office of Financial Aid, Education, and Planning put on a workshop entitled “Budgeting for Life.” I, alongside a group of my classmates, filtered into WB 128 partly to get my spending situation in order, partly due to the promise of sweet treats included in the email about the event, and mainly for the reason that I could not think of anything scarier than coming to terms with the reality of my finances. The session did not disappoint as Jennifer Hulvey, Senior Advisor to the Office, donned a witch costume (complete with a black hat) and cast a spell on the room with stories of financial mastery.

Pictured: Jennifer Hulvey in costume

Photo Credit: Brent Rice '25

First, Look Back

Instead of seeing the future, a look into Hulvey’s crystal ball would likely reveal a trip into the past. Hulvey shared, “every decision you make [about money] today is impacted by the nuclear family with which you grew up.” She encouraged the room to think about whether their memories about money growing up were good, bad, or something they didn’t have to think about at all, before sharing a few personal stories that have come to shape her relationship with money today. Her relationship, like the relationship of others who have come from relatively modest means, is centered around a discipline, guilt when spending, and a scarcity mentality that impacts all of her financial decision-making.

Then, Start Where You Are

As the presentation shifted more into the mechanics of budgeting, Hulvey emphasized that she understands how hard it can be to get going while stressing that budgeting, in order to be successful, needs to become a habit. If you are not sure where to start, she suggested you begin by simply tracking what you spend with a goal of understanding “what it costs to be you.” While there are numerous apps and tools out there to accomplish this task, Hulvey seemed particularly fond of a website/app called “You Need a Budget,” which offers a free year of service to students and comes with a suite of reporting and analytical tools.

The Four Rules of Budgeting

The conversation next turned to the magic formula for financial success—Hulvey’s four rules of budgeting.

Rule 1: Give Every Dollar a Job. This stands for the proposition that a budget should begin by taking a look at your income and spending/saving plan such that when you subtract the latter from the former, you are left with zero dollars remaining. For those who are not yet sure about what their income will be, Hulvey recommended visiting www.paycheckcity.com, where you can put in your projected salary and have it adjusted for federal, state, and local taxes.

Rule 2: Embrace your True Expenses. The goal behind this rule is to keep your budget level and avoid any large spikes in spending by accounting for everything in advance. This may involve saving each month for large holiday spending at the end of the year, adjusting for expected end-of-year tax expenses, and planning for annual vehicle maintenance.

Rule 3: Roll with the Punches. Recognizing that a budget is a tool to help you, Hulvey encouraged attendees to move spending allocations around in their budget when needed (either voluntarily due to desired purchases or involuntarily due to unexpected expenses) to make their budget fit their changing needs.

Rule 4: Age your Money. This maxim stands for the idea that you should live on your last month's income, rather than paycheck-to-paycheck, to avoid risk during unexpected turmoil.

Final Tips

The afternoon’s conversation also included a discussion of working with your life partner to understand both of your goals and make a plan that everyone can live with, a recommendation to get receipts for all purchases so that multiple items bought at one store can be properly allocated to their appropriate spending category, and to automate any payments and expenses that you can to take advantage of interest rate discounts and save time. It’s no TRICK; if you’ve found this article beneficial, my last piece of advice to you would be to stop ghosting your financial responsibilities and TREAT yourself to an appointment with the office to get more individualized assistance today.

---

wrf4bh@virginia.edu